average clause insurance formula|Broker Tip #8: How Does The Average Clause Work? : Tagatay Average Clause is a provision commonly found in insurance policies, specifically in marine insurance, designed to mitigate losses in cases where the insured property is undervalued at .

Discover the top online slots for real money at the best casino sites for 2024. Explore trusted platforms offering exciting slot games, secure transactions, and generous bonuses. . Yes, you can play online slots for free and have the chance to win real money through no deposit bonuses and free spins, but be aware of wagering requirements .

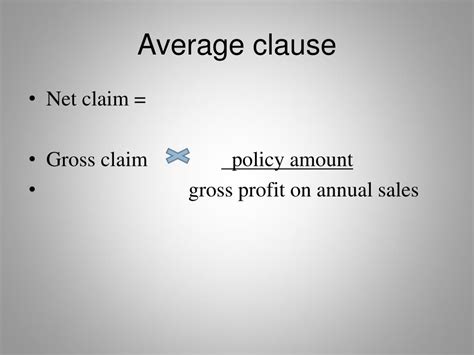

average clause insurance formula,Nob 24, 2020 — The amount of claim that the insured gets is calculated as follows: Claim amount = (Actual loss × Insured amount) / Value of goods or property at the date of loss. Suppose a property worth 1,500,000€ is insured for .What is the Average Clause in Fire Insurance? The Average Clause in Fire Insurance, also referred to as the "Underinsurance Clause," holds significant weight in fire insurance policies. .Dis 6, 2018 — So what is an average clause in an insurance policy? It is a clause requiring that you bear a proportion of any loss if your assets were insured for less than their full .

Hul 16, 2024 — The formula for calculating the Average Clause is as follows: (Sum Insured / Actual Value) x Loss Amount = Claim Payout. - Advertisement - Let’s break down this .Nob 14, 2023 — Average clause calculation: Although insurance documents are rarely simple, the average clause calculation (or ‘average clause underinsurance formula’) is fairly easy to .Average Clause is a provision commonly found in insurance policies, specifically in marine insurance, designed to mitigate losses in cases where the insured property is undervalued at .

Nob 23, 2020 — Understand what is an average clause - easily explained with a video. 📌These tutorials will offer you all the basics you need to master reinsurance Subscri.

Ene 31, 2020 — The formula determining average is as follows: (Sum Insured / Value at Risk) x Amount of Loss. Example. Let’s say Keith’s townhouse is insured for R500 000, but it’s .Peb 26, 2024 — Coinsurance Clause or Average Clause. An insurance policy for a property owner is accompanied by a detailed and complex contract that will contain clauses, provisions .average clause insurance formula Broker Tip #8: How Does The Average Clause Work? Hul 6, 2022 — This article explains in detail how the Average Clause can affect your company amidst rising inflation, and what you can do about it. What is the Average Clause in a Property Damage and Business Interruption policy? The .Ene 31, 2020 — The result is that you will only be paid a proportional part of your claim. In the event of a claim, the principle of ‘average’ would be applied. The formula determining average is as follows: (Sum Insured / Value at Risk) x Amount of Loss. Example. Let’s say Keith’s townhouse is insured for R500 000, but it’s actually worth R1 million.ADVERTISEMENTS: Formula for Calculating the Actual Amount of Claim! In case of under-insurance, the Insurance Company applies the Average Clause. Under-insurance means insuring for lesser value of stock. This is because businessmen think that in case of fire outbreak the complete stock will not be burnt. So, they take insurance policy for partial stock, of [.]Average clause in fire insurance to establish the insurer's liability for claim reimbursement. The insurers do not pay the full amount of loss caused by the insured. Claim; Get The App; Sales: 1800-309-0988; Service: 1800-572-3918 .Using the formula for the average clause that we’ve just tackled, let’s take a look at some real-world examples of the clause in action: Example 1: Meet Sarah, a savvy commercial property owner. She's insured her place for the market value of £400,000, thinking that had her covered.average clause insurance formulaThe average clause is often added to insurance and can be found in the small print of your insurance documents. The average clause is a way of insurers paying out less than they need to if a policyholder is paying less than the premium they .

the ‘Average’ clause which may be included in your policy wording. Making . claims clear. Underinsurance . and ‘Average’ Deciding to take out insurance is only the first step – insuring your valuables and assets for the correct value is equally important. Failure to consider this properly, and insuring for too low a value, can have .Peb 9, 2016 — An Example of the Condition of Average being applied in an Insurance Claim. If a policy of insurance covering a building has a sum insured of £80,000 and at the time of a loss the real insurance value is £100,000 then the proportion of Average would be £80,000/£100,000 or 80%. You will only receive 80% of any loss you suffer.Hul 6, 2022 — Meta description: Amid rising inflation, the Average Clause in business insurance policies can pose severe financial consequences for companies. Find out why. By Marian Joraschkewitz , Corporate & Commercial Segment Leader, Asia. 07/06/2022 Rising inflation poses multiple financial risks for companies across all industries. .

Hul 18, 2024 — Learn the Average Clause in Fire Insurance: Impact, Calculations, & Solutions. Protect your property wisely with Tata AIG's expert guidance. Personal. Motor Insurance. . To understand how the average clause affects your claim settlement, let us take an example and use a formula. Suppose your property is worth ₹50 lakhs, but you have insured .

Okt 16, 2018 — A short term insurance policy usually includes a general ‘average clause’ to indemnify the insurer should the value of an insured item at the time of the loss turn out to be greater than that stated by the insured on the policy schedule. The clause is included in policy wordings as a specific condition for all policies in the fire and .

Abr 2, 2020 — This project was created with Explain Everything™ Interactive Whiteboard for iPad.

Set 21, 2021 — If the fire insurance policy uses the pro rata condition of average, the insurance company is only liable in proportion to the level of insurance relative to the value of the property. Since the .

The average clause is a provision frequently found in insurance policies, particularly property and business interruption insurance. It acts as a safeguard for insurers, ensuring they only pay a proportional share of a claim if the insured property is undervalued at the time of loss.. In simpler terms: If your insured property is worth £100,000 but you only insure it for £80,000 .– Notice Explaining the Nature and the Effect of the Pro Rata Condition of Average (Average Clause) in accordance with Regulation 126 (5) of the Insurance Act. . of the Insurance Act. . and you suffer a loss from an insured peril, there are three possible scenarios depending on the size of the loss. The formula that is applied in each .Broker Tip #8: How Does The Average Clause Work? Many insurance policies include an ‘Average’ or ‘Co-Insurance’ clause (also known as the ‘under-insurance’ clause) which means if you insure for less than the full value of the property, a claim can be reduced in proportion to the amount of the under-insurance.

Peb 26, 2024 — Coinsurance Clause or Average Clause. An insurance policy for a property owner is accompanied by a detailed and complex contract that will contain clauses, provisions and responsibilities that are .average clause: [noun] a clause in an insurance policy that restricts the amount payable to a sum not to exceed the value of the property destroyed and that bears the same proportion to the loss as the face of the policy does to the value of the property insured — compare coinsurance.Hun 26, 2023 — The average clause, also referred to as the “underinsurance clause” or “co-insurance clause,” is a provision commonly found in fire insurance policies. Its primary objective is to ensure that policyholders adequately insure their property to avoid potential financial loss in the event of a partial loss or damage caused by a fire.

average clause insurance formula|Broker Tip #8: How Does The Average Clause Work?

PH0 · ‘Coinsurance’ or ‘Average Clause’ Explained and Case Study

PH1 · What is the Average clause in Insurance?

PH2 · What is an average clause?

PH3 · Understanding the Average Clause in Motor Insurance: A

PH4 · Understanding Average Clause: Definition, Purpose, and Examples

PH5 · How the Average Clause affects your business

PH6 · Broker Tip #8: How Does The Average Clause Work?

PH7 · Average clauses in insurance policies

PH8 · Average Clause in Fire Insurance